SimpleSwap Staking: Your Guide to Passive Crypto Income

In 2025, SimpleSwap staking is transforming how crypto investors earn passive income. As a non-custodial exchange with over 1,500 cryptocurrencies, SimpleSwap simplifies acquiring stakeable assets, blending speed, privacy, and low fees. Without direct staking pools, it serves as a powerful gateway to Proof-of-Stake (PoS) ecosystems, enabling instant swaps into tokens like Ethereum or Solana. Drawing from SimpleSwap's 2025 insights, such as their blog on staking versus yield farming, this guide explores how SimpleSwap staking unlocks high-yield opportunities. Perfect for beginners and pros, it’s your ticket to maximizing returns in the evolving DeFi landscape.

What Is Staking and Why Use SimpleSwap?

Staking means locking your crypto to support a PoS blockchain, earning rewards as Annual Percentage Yield (APY). Unlike energy-heavy mining, staking is accessible and green, with yields often ranging from 4% to 20% based on SimpleSwap io’s market updates. SimpleSwap excels by offering quick swaps into stakeable coins without KYC or account setup, ensuring privacy and control.

With SimpleSwap staking, you access tokens like ETH or ADA in minutes, ready for staking on platforms like Lido or Marinade. Its non-custodial model means no third-party holds your funds, aligning with DeFi’s ethos. Recent SimpleSwap io analyses highlight how Ethereum’s Dencun upgrade boosts staking efficiency, making the platform a go-to for entering high-return networks seamlessly.

How to Start Staking with SimpleSwap

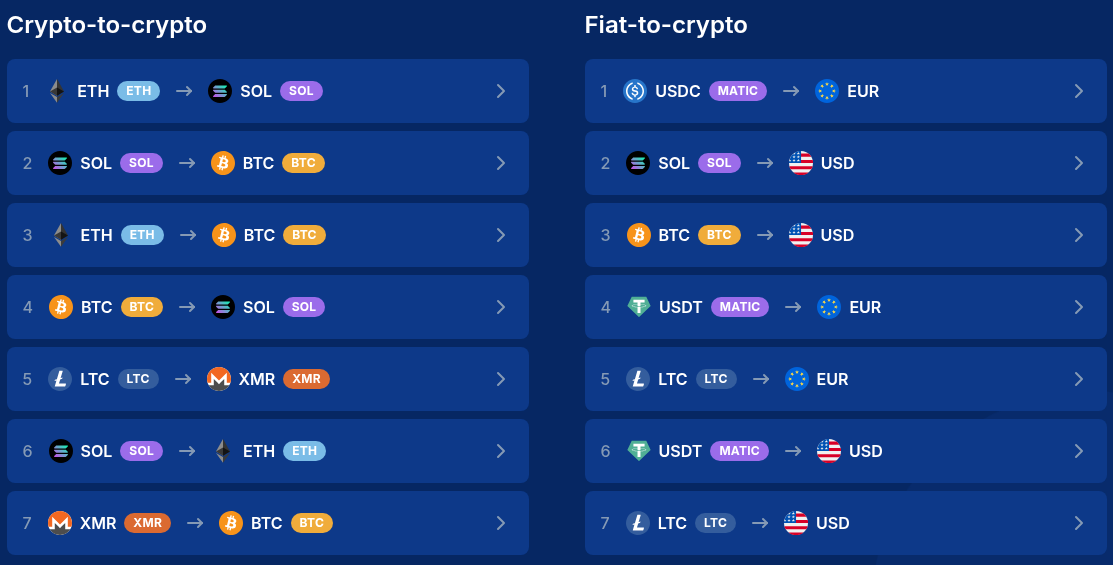

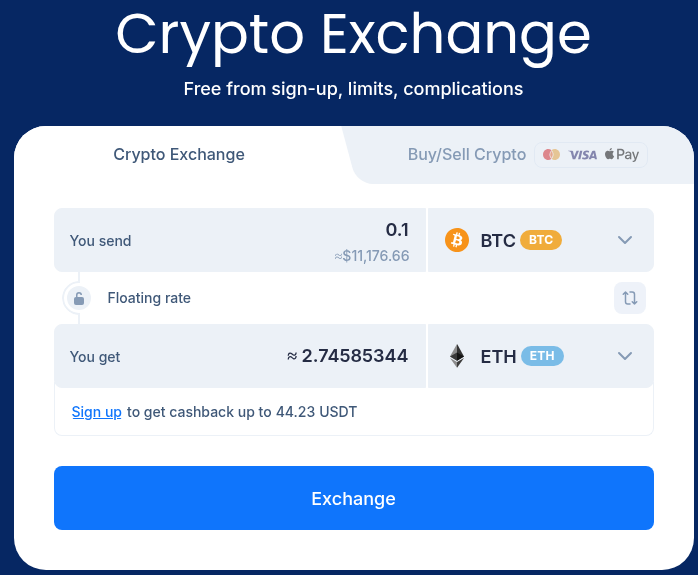

SimpleSwap staking is user-friendly, combining fast swaps with external staking tools. First, set up a secure wallet like MetaMask or Phantom to store your assets. On SimpleSwap’s website, select your source currency—BTC, USDT, or fiat via on-ramps—and swap into a stakeable token like SOL or DOT.

Swaps complete in minutes with transparent rates, as SimpleSwap eliminates hidden fees. Once you receive your tokens, move them to a staking platform: for ETH, use Lido to stake as little as 0.01 ETH for 4-6% APY; for SOL, Marinade offers mSOL with 6-8% returns. SimpleSwap io’s guides suggest timing swaps during low network congestion to save on gas fees.

Track rewards via blockchain explorers and reinvest earnings by swapping back through SimpleSwap. Their 24/7 support and rate calculators ensure a smooth experience, minimizing risks like high transaction costs.

Best Coins for SimpleSwap Staking

Choosing the right assets is key to SimpleSwap io staking success. Ethereum (ETH) delivers steady 4-6% APYs via Lido or Rocket Pool, with SimpleSwap enabling instant fiat-to-ETH swaps for easy entry. Solana (SOL) offers 6-8% returns, though network hiccups require monitoring; SimpleSwap’s cross-chain swaps make SOL accessible from obscure alts.

Polkadot (DOT) yields 12-14% but involves a 28-day lockup, with SimpleSwap supporting rare DOT pairs for portfolio diversity. Cardano (ADA) provides 4-5% through delegation pools, starting at 10 ADA, ideal for long-term holders using SimpleSwap’s fiat gateways. Avalanche (AVAX) offers 8-10% for subnet staking, and SimpleSwap’s speed suits its fast-paced ecosystem. These projections, sourced from SimpleSwap’s 2025 DeFi reports, vary with market conditions, so check StakingRewards regularly.

Advanced SimpleSwap Staking Strategies

Elevate your SimpleSwap staking with expert tactics. Try liquid staking loops: swap to stETH on SimpleSwap, lend on Aave for up to 10% combined

SimpleSwap Staking FAQ

What is SimpleSwap Staking?

SimpleSwap Staking allows you to earn passive rewards on your cryptocurrencies by locking up assets in supported networks. Through SimpleSwap's user-friendly platform, you can stake popular coins like Ethereum, Cardano, and Polkadot directly, without needing complex wallets or exchanges. SimpleSwap simplifies the process, making staking accessible for beginners while offering competitive APYs to grow your holdings securely.

How Does Staking Work on SimpleSwap io?

With SimpleSwap staking, you deposit eligible cryptocurrencies into a staking pool managed by the platform. SimpleSwap io handles the technical aspects, such as validator selection and network participation, ensuring your assets contribute to blockchain security. Rewards are distributed periodically based on the network's protocol—typically daily or weekly—and automatically added to your balance. SimpleSwap's non-custodial approach means you retain control over your private keys, enhancing security.

What Cryptocurrencies Can I Stake on SimpleSwap?

SimpleSwap supports staking for a variety of top cryptocurrencies, including ETH (Ethereum), ADA (Cardano), DOT (Polkadot), ATOM (Cosmos), and SOL (Solana). The platform regularly updates its list to include emerging assets, so check the SimpleSwap dashboard for the latest options. Each coin has unique staking requirements, like minimum deposits, which SimpleSwap clearly outlines to help you choose wisely.

What Are the Benefits of Using SimpleSwap for Staking?

SimpleSwap staking offers high-yield rewards—often 5-20% APY depending on the asset—without the hassle of running your own node. It's commission-free on SimpleSwap, meaning more earnings stay in your pocket. Plus, SimpleSwap's instant setup and real-time tracking make it ideal for passive income. Users appreciate the low entry barriers and transparent reward calculations, turning SimpleSwap into a go-to for efficient crypto staking.

Is There a Minimum Amount to Stake on SimpleSwap io?

Yes, SimpleSwap staking requires a minimum deposit per asset to participate effectively—typically ranging from 0.1 ETH to 10 ADA, varying by network. These thresholds ensure optimal reward distribution while keeping SimpleSwap accessible. If your holdings are below the minimum, SimpleSwap io suggests pooling options or waiting for network updates that lower barriers.

How Do I Start Staking on SimpleSwap?

Getting started with SimpleSwap staking is straightforward: Log into your SimpleSwap account, navigate to the Staking section, select your desired cryptocurrency, enter the amount, and confirm the lock-up period. SimpleSwap processes the stake instantly, with rewards accruing from the next epoch. No KYC is needed for most stakes, and SimpleSwap provides step-by-step guides to ensure a smooth experience.

Can I Withdraw My Staked Assets from SimpleSwap?

Absolutely—SimpleSwap staking is flexible, allowing unstaking at any time after the initial lock-up period (usually 7-28 days, depending on the asset). Once unstaked, funds return to your SimpleSwap wallet within the network's confirmation time. Note that rewards may be subject to a short cooldown, but SimpleSwap minimizes downtime to keep your assets liquid.

What Are the Risks of SimpleSwap Staking?

Like all staking, SimpleSwap involves risks such as slashing (penalties for network downtime, rare on SimpleSwap's vetted validators) and market volatility. SimpleSwap mitigates these with diversified pools and insurance funds. There's no lock-up risk beyond chosen periods, and SimpleSwap's audits ensure platform reliability. Always stake what you can afford to hold long-term.

How Are Staking Rewards Calculated on SimpleSwap?

SimpleSwap calculates rewards using the network's native formula: (Staked Amount × APY × Time Staked) minus any minor fees. APYs fluctuate with network participation, but SimpleSwap displays real-time estimates. For example, staking 1 ETH on SimpleSwap might yield 0.05 ETH annually at 5% APY. Track everything via your SimpleSwap dashboard for accurate, personalized projections.

Is SimpleSwap Staking Secure and Beginner-Friendly?

SimpleSwap prioritizes security with multi-signature wallets, cold storage, and regular third-party audits. For beginners, SimpleSwap io offers intuitive tools, educational resources, and 24/7 support to demystify staking. Whether you're new to crypto or a seasoned holder, SimpleSwap makes earning rewards simple, safe, and rewarding.